Electronic Signatures have become standard

Consumer habits are hard to change. However, once they are in place, behaviors can become so automatic, customers barely think about the activity. In fact, the majority of debit and credit card providers converting to the new chip technology opted for electronic signatures as the primary form of authorization, despite the fact that PIN numbers are significantly more secure. Why? Because that’s how customers are comfortable paying for goods and services.

Consumer habits are hard to change. However, once they are in place, behaviors can become so automatic, customers barely think about the activity. In fact, the majority of debit and credit card providers converting to the new chip technology opted for electronic signatures as the primary form of authorization, despite the fact that PIN numbers are significantly more secure. Why? Because that’s how customers are comfortable paying for goods and services.

Electronic signatures have become the standard for payment authorizations and loan contracts. Each signed debit or credit purchase signifies a signed contract by the customer, who does not actively think about the contract and obligation for repayment. It’s just automatic.

The CFPB Reg E Compliance Bulletin

Due to the increased popularity of electronic signatures, the CFPB issued a bulletin in November 2015 clarifying steps required to remain compliant with Reg E statutes concerning debt collection activities. Companies can capitalize on customers’ comfort levels with eSignatures, while remaining compliant with Reg E, provided they use software that follows the CFPB’s requirements.

The November Bulletin reiterated that Reg E compliance includes authorizations accepted through electronic means, the phone, and the computer. Preauthorized payments require authentication of the customer and a copy provided to the customer, in paper or electronic form, with evidence of the customer’s consent.

Verbal authorizations are acceptable as long as they are collected through a process associated with a contract, the customer has intent to sign, and the contract’s electronic communications are sent. Recording a code into a telephone keypad can satisfy Reg E compliance based on the electronic signature guidelines.

PDCflow simplifies Reg E Compliance

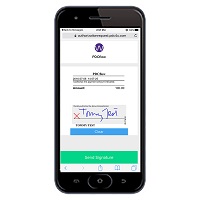

Fortunately for the industry, software companies like PDCflow, simplify the payment process, can obtain electronic signatures quickly, and fully comply with the new CFPB standards.

PDCflow developed proprietary software enabling you to obtain eSignatures through a simple, efficient, and compliant process. The software features Dual Authentication and Geo Location Tracking, which verifies the consumer’s identity and maintains evidence. The Signature can also be achieved through any touch device such as a mouse or mobile device, through its eSignature Flow system. Companies can send a document, such as the terms of a Recurring Payment Schedule, with the proper authorization language. The client signs and returns the form electronically, giving all parties signed copies instantly.

For more information on how eSignatures can make the process easy while remaining fully compliant click here or contact PDCflow at 877-732-4814

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)