Last week, the Federal Reserve announced a new stimulus program dubbed Operation Twist to boost a faltering economy. The plan calls for recasting its $2.65 trillion securities portfolio to reduce long-term interest rates.

The Fed hopes Operation Twist will boost investment, spending and positively impact the struggling housing sector. Simply put, it is designed for the Fed to sell some $400 billion in shorter term Treasury securities and reinvest the proceeds into longer term securities. In addition, the Fed will reinvest into mortgage-backed securities, reversing its trend to shrink its mortgage portfolio. Officials had previously decided to shift their portfolio away from mortgage bonds as the economy improved but their decision to stop that process points toward a concern that the economy has not improved anywhere near as fast as they had hoped.

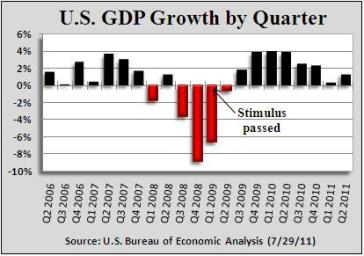

Stimulus programs of recent years past had a profound yet unsustainable impact on recovery efforts. The last stimulus effort brought $600 billion directly into the hands of the consumers.

Stimulus programs of recent years past had a profound yet unsustainable impact on recovery efforts. The last stimulus effort brought $600 billion directly into the hands of the consumers.

Operation Twist, by comparison, is a longer term approach that will not impact the consumer’s ability to spend or pay down debt in the short term. Even before its implementation, it is already impacting long-term interest rates and affecting what bond investors are buying and selling. Some suggest this will have a more significant impact on a sluggish economy and maybe it will. I suggest it will not boost recoveries in the short term because it is not designed to create jobs or putting money directly into the hands of the consumers. As economic growth remains sluggish, job creation stalled and the unemployment rate stuck collectors and recovery managers should not look to Operation Twist to boost liquidation results.

Mike Ginsberg is President and CEO of ARM advisory firm Kaulkin Ginsberg, and can be reached by email. The firm is celebrating its 20-year anniversary in the ARM market.

Mike Ginsberg is President and CEO of ARM advisory firm Kaulkin Ginsberg, and can be reached by email. The firm is celebrating its 20-year anniversary in the ARM market.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)

![Whitepaper cover reads: Navigating Collections Licensing: How to Reduce Financial, Legal, and Regulatory Exposure w/ Cornerstone company logo [Image by creator from ]](/media/images/Navigating_Collections_Licensing_How_to_Reduce.max-80x80.png)

![Whitepaper cover text reads: A New Kind of Collections Strategy: Empowering Lenders Amid a Shifting Economic Landscape [Image by creator from ]](/media/images/January_White_Paper_Cover_7-23.max-80x80.png)