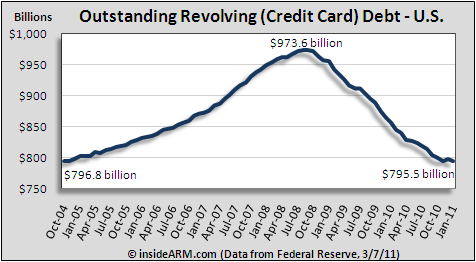

After breaking a 27-month losing streak in December 2010 with a small gain, consumer credit card debt outstanding fell by more than 6 percent in January according to data released late Monday by the Federal Reserve.

In its monthly Consumer Credit statistical release (G.19), the Fed reported a $4.2 billion decline in revolving debt outstanding, which is almost entirely comprised of credit card debt. The measure fell at an annualized rate of 6.4 percent after increasing at a 3 percent rate in December 2010.

Total consumer credit card debt outstanding was $795.5 billion in January, down from a peak of $973.6 billion in August 2008.

Non-revolving debt – principally made up of closed end accounts like student and auto loans – increased in January at an annual rate of 6.9 percent. Non-revolving debt was buoyed in the month by auto and student lending, according to the Fed.

Total outstanding debt in the U.S. was $2.412 trillion in January. The Fed’s G.19 numbers do not include debt backed by real estate.

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![[Image by creator from ]](/media/images/Skit_Banner_.max-80x80.jpg)